.

Quarter to ten, I slog on my toes wearing my lanyard to TiECon, Chennai. The buzz, excitement, and madness I recall from the golden years Chennai had is back ON. This year, at ITC Chola, the startups at Chennai perhaps witnessed a great phelothra of suits, than tees. I mean Angels Vs Developers. A full house of hungry saber-toothed wolf-pack of entrepreneurs, brimming with ideas, looking eagerly at passionate & caring Angels/VC’s green. Or, perhaps not? Parading my way near to the inaugural stage, I found the hall amazingly decorated, and buzzing with activity. Many dreamers with their one-line pitches & MVPs looked forward to network, grow their startups, be mentored, and get funded today.

It was an important day. We all had the privilege to listen to some of the eminent personalities like Ashok Soota. CEO, Happiest Minds, an ex-Wiproite and more popularly known to many as the co-founder of MindTree. I am sure his books & works continue to inspire a lot of entrepreneurs.

“Be with the pace of change. Ideas boom the young entrepreneurs. Don’t grab the first money you get from VC. It’s important that it is intelligent money. ” he said. But lastly, I could not agree with his views that getting startup funding in India was “easy”. Apparently, not! Many Indian accelerator’s funding are intangibles. I keep wondering as I write, if this was my personal prejudice I made towards VC/Angel cash-cows or a inherited biased view point shared by a majority?

Another session was from Alibaba’s Data Scientist, Dr. Danfeng Li, who hinted their interests opening up their expertise with India. After their acquired the most popular $1bn Lazada Group deal last April, I won’t be surprised if one of the niche e-commerce companies will offer a stake or negotiate a full buyout in the coming months. Found it hard to believe, not many knew how popular & growing the e-commerce Lazada Group is in countries like Malaysia & APJ region, as compared to AliExpress.

“Entrepreneurship is an extreme sport. And, if you are a product startup with a flaw, highlight it.” The stage was set with talks from well-established stalwarts like Kris Gopal, Anup Bhagchi, Ranjit Menon, Ashok Junjhunwala & Rajeev Lochan. Impressive Q&A.

Many did feel ‘super-charged’ by a session on ‘Enthusiasm’ by Rijn Vogelaar, a Hollander, Author of The Superpromoter & The Enthusiasm Trilogy. “Negative feedback is better than no feedback. Enthusiasm is Vulnerable. We are inhibited with enthusiasm.” Dank je wel. That was interesting quotes.

Next was a the one-to-one interaction at the polyclinic booths, which had people lining up to Mentors asking all help they could regards to compliances, legal requisites, strategies, and funding opportunities for their startups. I only wished, this session was like Dragon’s Den.

Mumbai based Ambareesh Murthy of Pepperfry added few interesting lines. “If you do not grow, there is no point in running a business. How you leverage your insights is key. Insight and uniqueness of business are value drivers. If you know your customer & your insights, it will build your brand. If you have a contribution margin then your biz is profitable. Have differentiation. Believe. Define UVP. Differentiate in the culture you build.” Impressive talk.

Ecosystem- The # of startups as per Nasscomm's 2015 report- 26% Bangalore, 23% Delhi/NCR, 17% Mumbai, 8% Hyderabad, 6% Chennai. (Courtesy- Venture Intelligence, Chennai)

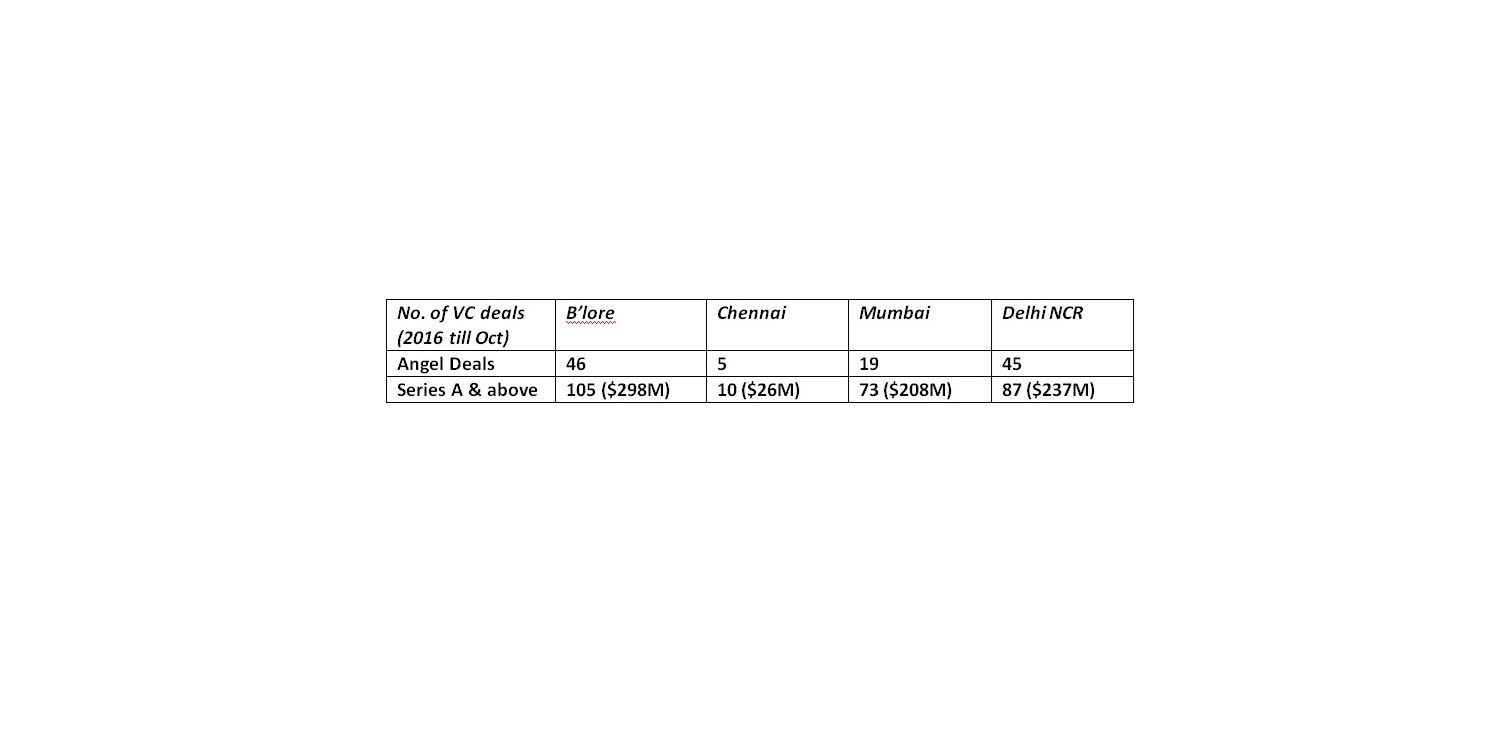

Funding Let' study the City-wise breakup of the Indian startups. Here's a small slide showing why Chennai is a shy by few points.

And, don't be surprised B'lore gets a chunk of the pie. Do you know, 80% of people getting funded are outsiders in Bangalore and Delhi/NCR. Non-chalantly, I found it hard to accept the startup valuations, presentations, and P&L reports, but I did consider some incredible work done by many. Yes, the money raised by few startups, in their limited capacity is really impressive, and continues to grow.

Behind an array of diesel generators, I arrived to find a lot of smokers in ties, debating, and discussing a who's who in the industry, and sharing the pains on getting their startup funded. Believe me, for the entire 2 days, I had a hard time to pulling out my pocket calculator out, converting millions to crores, and dollars to rupee. Not surprised, many loved talking in USD. Old habits die hard, perhaps?

Yes, I did sense disruption happening. Many startups were innovative. The biggest thing for startup is they need to see early revenue, which most companies find it hard to achieve, operating on losses and running debts. Many relentlessly are trying to insulate themselves from disruption, and it continues to affect them indirectly in the long run. Lesser said, taking a contrast with global economy, we can't stop currency devaluation even if USofA's $20Tn debts are settled in full. Software is eating software for breakfast, and it is happening so fast. Disruption never ceases to surprise, in its many forms.

“Banks fear Bitcoins. Hotels fear AirBnB. Taxis fear Uber. Media/TV fears VICE.”

…. Day1 Ends.

Vijay Kapoor of Derby kicked the sessions next day. A few lines he quoted — “The goals and visions of the company is far more important than individual egos. Keep the vision above everything else. Communication is about empowering the other person.”

Next, Mr. Velumani was the show's rock-star with his Rajini punch-lines. He had a standing ovation for a non-tech pharma-based franchise venture he had built that now is valued a 1000 crores. Appalling, seriously. His quotes - “Restlessness is very important for entrepreneur. Focus, learn, grow and enjoy. Villages are true universities. The luxury of poverty is the luxury of life. If you don't lose a million you won't earn a billion. Comfort zone is Danger zone — Run Run Run.” All this on jam-packed Day2, and I can't believe the keynote session had exceptional Ranjikanth's Kabali references.

DaveMcCaughan made a quote I liked — “#1 thing business have to think is what matters to people you are selling to.” Know your audience. It really matters.

Apparently, there were certain sessions I did not have access to directly on Day2. Unconference session hosted by Notion Press, a self-publishing platform, had networking on thought leadership through writing. A few take-aways - “Write for just one person. And that person is you. Hard task is finding a publisher! Reasons people don't pursue writing. Forming writing groups and a strict deadline works magic! Focused writing time helps. Everybody has a story. We learn from our experiences. It's important to share it with the others.”

Mr. Ashok Jhunjhunwala's session was really freakonomics. He gave so many numbers — “Sigma of all investment in start-up companies is less than market cap of Apple. 70% of attrition happens within 5 years for a start up. Delivery vs Payment have got disrupted. Business which got disrupted are the ones who miss big trends. The best career opportunity for a bright student is a startup.”

Why Event Marketing matters? If you are at an event relevant to you, network! I could spot some random bits of aggressive efforts by startups, which wanted to establish a presence, which was a good sign. From the doctor gowns to life-sized doll mascots, Day2 was still buzzing with random 6 figure $ values that reminded me Ocean's Eleven. The most happening thing was the PitchFest. A startup called Detect Technologies bagged the prize money for their product ideas. Impressive work! PitchFest was the interesting segment.

It was Awards Night, but I never liked the concept of Awards Night for 2 reasons. Firstly, an already convinced audience who knows who will win. Secondly, we know the cash awards reach already well-funded, well-established ventures who have successfully established a global presence.

Many wise men today with lapel mics & power-point presentations did teach us what they learnt over their lifetimes. Their failures make others thread things with caution. Extremely happy a speaker mentioned these tips — No EMI. Key take-aways - “Getting funding is not objective of startup but creating value which solves problems. Focus on niche. Work on market-product fit. Do not get hyped by large funding. Validate. Equity funding must be last resort.”

And, IIT-M launched the 8th Annual Report on Indian VC and PE on Start-ups, at TiECON 2016 which had collected interesting figures, which I bet took them a decade to collect. Did find it hard to summarize as a report, but here's few details in bullet points.

Ø The number of first time angel investors has grown at 98%, the growth rate of investors who are reinvesting has been 105%.

Ø There is decrease in average age of startup at the time of receiving angel investment from 4.77 yrs in 2008 to 0.54 yrs in 2015.

Ø While the average number of incubates is around 36 in universities, it is only 13 in the case of private non-universities. 17 accelerators have supported a total number of 1816 start-ups.

Ø 56% of incubators are located in universities, indicating the important role played by universities in supporting start-ups. More than 50 percent of the incubators were set up in the last five years.

Ø For every 875 start-ups that get founded, only one is able to successfully raise 4 or more rounds of funding. 75 of the 875 are able to get 1st round funding, out of which only 15 are able to get 2nd round of funding.

Ø Start-ups that were a part of incubation or accelerators also had a higher maturity index (3.4). The average maturity index of start-ups that have received funding was 3.54 whereas those that did not get any funding were 3.4.

Ø Angel funding Investment rounds are more than 40% higher in Tier 1 cities as compared to that of Tier 2 cities. The 6 Tier-1 cities of India received the largest chunk of investment of $661.29 billion. Tier 2 cities received 31% of the total investment and start-ups in Tier 3 cities accounted for $19.74 billion.

Ø Tamil Nadu and Gujarat has the highest number of SMEs, but they are not the top states in terms of venture funded start-ups.

Ø The average investment made by an individual angel investor has increased from $2.16 million in 2009 to $16.95 million (Did you know, Ratan Tata's was $36M alone!).

Ø The average investment received from an angel round by a start-up has increased from $10.63 million in 2009 to $46.76 million.

Ø In a span of 7 years, the numbers of angel networks have increased 20 times. The annual growth rate of the number of investments by angel networks during the 2009–15 periods has been about 75%.

In an open letter to the organizing team, I really insist the TiE team to document their content professionally in a narrative manner, take UGC from the social media, add speaker videos, and make an extremely simple “post-show report” by the event night, intended for the future delegates, sponsors, exhibitors, and visitors. Rest apart, TiECon was all well executed conference.

People love events, for their good food and networking experiences. Water-cooler gossips with suits (VC/Angels) can happen at times you least expect, and with whom you least expect. IMO, have your 1 minute elevator pitch ready at events, and make sure you hand over your V-card promptly, and politely.

A few years back, I did volunteer, help organize, participate and work for many events associated with TiE Chennai, IIT-Madras & its partners. But, with time I rarely believed I must network & grow. I missed the bus & had several reasons why. Many speakers didn't have an agenda. No names taken. But we must take time to appreciate the efforts of many souls who devoted themselves making the event a success. Yes, it was a well-organized flawless event. Good work TiE Chennai. 1450 “super-charged” people left the place with ideas for more disruptive world dominance!

It's dark, and 7.30. Curtains close. Mic drop!

Thanks for reading!