.

… After a failed start to raise capital, I am running my 2nd innings of operations at my software publishing and consulting services startup. I restarted and have slowly gained traction, but steadily. I am penning a few words why I think raising money is hard part.

Banks

Not many banks understand how SaaS products differ from regular software services. I believe there is a generation gap, and not every one are aware of SaaS product metrics. Most still believe in the concept of $1X,XXX workorder contracts as a minimum requsite to secure a 80% loan, at a rate of interest on business loans are twice that of personal loans. We have steadily subsidized borrowing costs of Government. With those subsidies instead of being paid to millions of SMEs/entrepreneurs goes, it goes to 1% capitalists mining coal in foreign nations. When the whole world is moving towards personas, design thinking and ways for a consumer connect, bankers expect a contract with biz? This apart, one needs a collateral, good people who can vouch for you and a honest credit scrore.

We live in a world of disparity. We live in a country where, no matter what form of governance dictates, the interest and tax rates are perhaps altime highest. In UAE, you pay 0% tax for personal income. Else where, in rich countries like Japan, you’ve negative interest rates, wherein you pay the banks to keep your money. And, USA’s corprate tax rates are even lesser than India, seriously. No wonder they can afford to print their own money even after sinking in $19T financial debt. And, many of these foreign firms secure a easy loan for business at 2–3% rate of interest. No red tape! Those denied any role for their rights in first place are obliged to pay resulting fines — indeed, what other reason could there be taxes?

Venture Capital

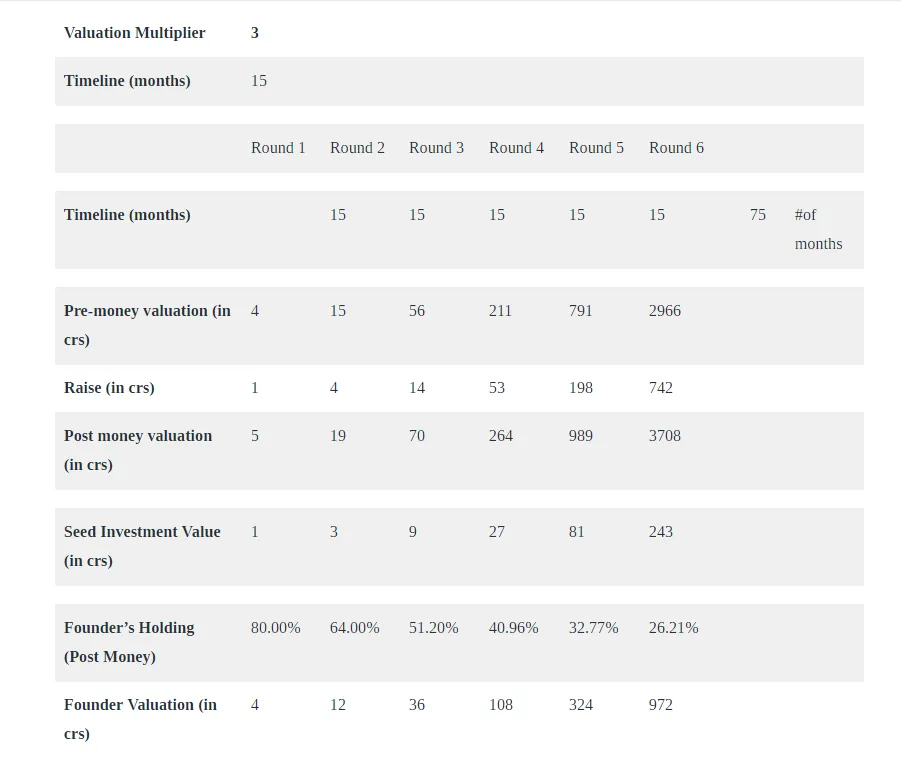

Do you envy the news of a new funding round breaks the headlines? Shun them. That’s the last door you may ever need to knock at, perhaps? Venture Capital funds have to show an IRR of 40%. That’s a huge number, and why? One word — Risk! They want such a return on investment only because, the world won’t call you a bluff. A few fund management experts say they deserve a bigger number. To put in terms, read the explaination below from this blog. Apparently, the only reason I beg to differ from the shoes of this Angel investor is the “opportunity loss” he considered to be carried over by one sucessful startup for the 9 loss making ones. Yes, 90% formula is the risk they are willing to “gamble”.

Link: https://showmedamani.com/2017/05/18/part-2-early-stage-investment-math-the-rule-of-3x/

Many don’t understand money from the sharks is a bait. Ask yourselves — Who has the controlling interest in times when you end up buring all cash? Who sits on the board’s chair when you can’t show the numbers? Who makes the decisions around when you lose your equity? The most common mistake is taking money you can’t return.

Let’s take an example you might probably understand. What’s the rate of interest for a savings account? 4%. What’s the rate of interest for a loan? 12% What’s the rate of interest for a credit card? 36% What’s the rate of interest for a VC Money? Any guesses? Here’s the math — Say you took some investment from a VC, and for every Rs. 1000/-, you are expected to return Rs. 26,843.50/- back to them in the next 7 years with an assumption of 60% IRR. Isn’t that a mind blowing figure?

Don’t go to a VC unless you are able to show that margin for your asset. VC invest in you because they believe you’ve a asset worth the bargain. How is creating liabilities more profitable than assets? I am not saying taking debts is bad. But is our system capable of giving such loans to some 1% undeserving fucks. 90% India is informal sector. If they ask loan. the bankers ask collateral. The same does not happen for salaried workers at MNCs. But, can we deny how borrowing, mortgages, sub primes, and credit cards made Americans homeless citizens w/out addresses today?

Margins

One thing common about every trader is, they love to brag the X00% fold percent returns they made on their trade. If you are jumping the boat, you’ve drunk their kool-aid. So, think twice.

- What asset are you selling to end consumer that multiplies in value?

- Is there a tangible assets that is tradable legally?

Most startups will evade this question #1. Most services chop-shops will ignore #2. Many startups fueled by Angel/VC investments, don’t look forward beyond creating sales orders. A classic example was how a food ordering service, that decided to automate orders as ‘confirmed’, even if the restaurants were closed and later refunded with 2x the amount in coupons. In all, they end up creating commision on sales, and independent 3x orders worth 67% value.

NPV= ∑ [ Period Cash Flow / (1+R) ^ T ] - Initial Investment

Governance

We consumers of capitalism is astonishingly good at creating wealth but lousy at distributing it. If few continue to celebrate such a dysfunctional economic system, they must assume responsibility for inflation, chaos & discontent. Many decades since economy has collapsed, & counting deterioration. Corporate tax loopholes have weakened purchasing parity of a wage worker.

“… The highest form of knowledge is empathy, for it requires us to suspend our egos and live in another’s world.”

Demonetization — The Artificial Recession

VCs now are milking their investments from a crisis. Global trade is inevitable. Ban on the soverign has caused wide spread cash balkanisation. All trade is conducted for the benefit of participants. The buyer & seller. Why are Bay Area/Chinese funded startups eating our humble pies? When a 3rd party get b/n a buyer and seller then chaos usually ensues.

Govts shouldn’t be making deals w/ cash rich venture-funded startups. A contractor whose job vanishes is loser in current situation. Telling him otherwise will not convince him & probably make him do opposite. This crisis showed the underbelly of our system.

What training & accounting practices have been absorbed by SME/SMBs (Small Medium Enterprises) in the informal economy for the transition? It is pretty easy for those with auditors and accountants to do biz. Not a small trader whose livelihood depends on countless of illiterates. Most of the evils thrive in formal economy. How many $$s are being charged per hour by MNCs? How much revenues are the companies making? I can daresay, many auditors are the perpetrators of fraud.

VC to Founder- What safety do we have if you run away with money? Founder- What safety do LPs have if you run away with their money?

Only 7% of India’s population is in formal economy. This includes unorganized sectors, excluding farming. Does india even has easy taxation? An integrated policy framework for the transition to formal economy should include the promotion of entrepreneurship,including co-operatives. IMO, cash is the lubricant of the economy. A study by CMIE has said — enterprise sector incl small & medium biz will bear 48% of total transaction cost incurred due to demonetisation. Households will bear 12% of the cost while banks will incur 27% of it. The government & RBI will bear 13% of total transaction cost.

Post-demonetization crisis

One of the top Angels exited India. Another, seed fund manager left to US citing operational inefficieny for doing business in India. Persistent selling of Indian equities by FIIs and weakness in other Asian currencies also contributed to the depreciation of the INR. And, by Nov 2016, Indian rupee plunged to new 5-month low against US dollar. Innovation is a very difficult thing in the real world.

India is a country where about 98 percent of consumer payments are made in cash. It takes >6 months for 23 bn notes totaling 15 Tn rupees. People in India who survived for weeks on less than $29. Sectors Affected by India’s cashban 1. Real Estate 2. Gold 3. Two-wheelers 4. Consumer Durables 5. Micro Finance.

Loan-repayment installments & disbursements did not happen due to a shortage of currency notes. Microfinance companies that disburse loans to poor people will faced severe difficulty collecting or disbursing cash in for months. No wonder, two-wheelers stocks were big losers on India’s benchmark S&P BSE Sensex index, and fell between 4% and 6%.

According to various estimates, the current volume of gold in Indian households is above 20,000 tons. And, even temples have 9000 tonnes. If people are no longer able to use 500 & 1,000-rupee notes to buy gold, they’l have to put it into banking or invest it in stocks or bonds.

Real Estate

Builders often accept 10% to 20% of an asking price in cash to lower both the buyer’s and seller’s tax liability. Many property transactions in India are made using cash. But that does not mean builders are making profits? All lives matter. One cannot simply smear ink on one sector & claim solving this will solve all the problems. Real Estate has been facing a lot of crisis since 2014. The real estate, so far this has been lacklustre in past four years due to various factors. now, 0% liquidity in the hands of buyers.

There are so many MNCs, corporates which owe over 75000/- crores in arrears itself. This figure is NPAs apart. Why not name shame them? 90% of IT tax arrears owed by just 12 ppl. India is democracy? What do honest law abiding tax payers look like? Certain co-op banks don’t deduct TDS for certain deposits.

If demonetisation is radical, jumping in well is also quite radical, isn’t it? To hunt crocodiles, the pond was dried. No crocodiles were found, for they can live on land too. But the small fish died. Feeling quite sad, for all those who died in bank queues, getting inked, & forced to be there, despite illness. 1000s of crores stolen from bank as loans are written-off. While those exchanging own money are marked with ink like thieves. Eight hundred crore people in this country earn less than Rs. 10000 a month. That is not black money. A family walked 20 km from Bastar. What is sickening is despite slump in intl markets, demonetization has created an artificial recession. Demonetization is an ill-planned knee-jerk scheme.

Why Economy sucks

“There is no free lunch” Who benefits from such moves? The 1%. Balanced trade is very important. None can change anything until they have an understanding of exactly what those causes are. The real world is not like the UTOPIAN models and we have never put in place these mechanisms. There are always consequences, and when you break the monetary value there are unknown consequences, that create unintended consequences.

“Opinion is really the lowest form of human knowledge. It requires no accountability, no understanding.”

Jobs, Trade & Globalization

We have been approaching the economic malaise from the wrong end. Wealth distribution is not the first problem we tackle. All Power Corrupts. Everybody lies. No one is innocent or ignorant here.

Parting notes: I’ve never borrowed a dime yet, to make my ends meet, but this apart there are recurring tech debts like costs of running servers, marketing et all. It is generally wise to shut up when people talk money. If you are one of those kids who made the headlines about startup getting funded, don’t brag. Work hard. And if anything should nevertheless interfere, what’s stopping us?